Is vision insurance worth it? This question often arises as individuals weigh the potential costs against vs the advantages of its coverage. In this blog post, we will explore the functionality of vision insurance, analyze its costs, and assess the benefits it offers. You’ll gain insight into scenarios where this type of insurance proves valuable, along with guidance on what to evaluate before making a purchase. Understanding these factors will help you make an informed decision about whether to invest in vision insurance, alleviating concerns about your health care choices.

Understanding Vision Insurance and Its Functionality

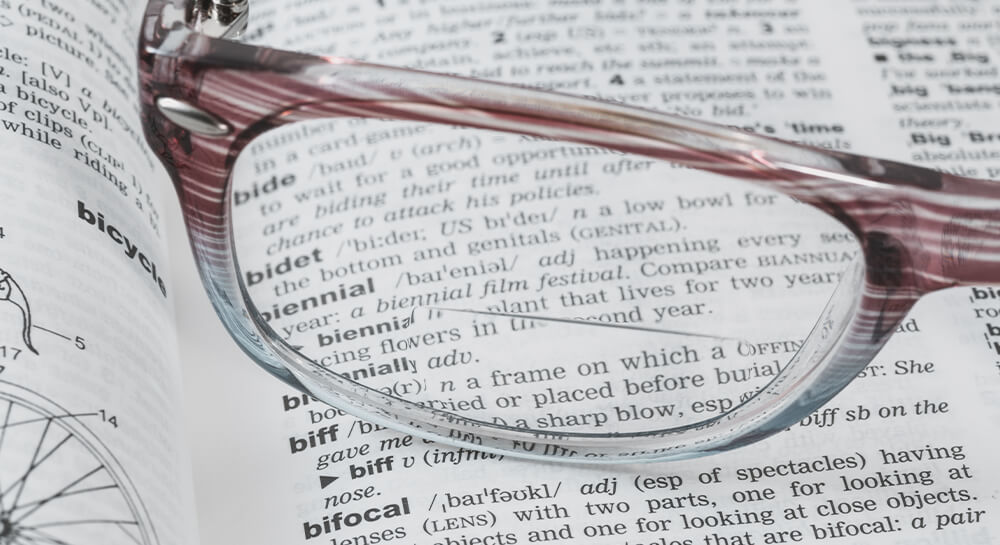

Vision insurance provides financial assistance for eye care expenses through various policy options designed to cater to individual needs. Common coverage options typically include routine eye exams, lenses, and frames. Understanding key terminology is essential for navigating vision plans effectively, helping consumers make informed choices based on their payroll deductions and the specific data regarding what each plan covers.

Definition of Vision Insurance

Vision insurance is a specialized plan designed to assist patients with the costs associated with eye care. This includes routine exams that help monitor eye health, as well as coverage for corrective lenses and frames. By providing this financial support, vision insurance aims to ensure that individuals can maintain superior vision without incurring overwhelming expenses that may strain their income.

Common Coverage Options Offered

Common coverage options in vision insurance typically encompass routine eye exams, prescription lenses, and frames. For example, plans like Davis Vision often provide a range of benefits, aiding patients in managing eye care expenses effectively. Beyond basic eye exams and eyewear, vision insurance may include discounts on additional services such as prescription medications for eye conditions or specialty lenses.

Key Terminology Associated With Vision Insurance

Understanding terminology associated with vision insurance is vital for making informed decisions regarding eye care. Terms like “co-pay,” which refers to the fixed amount paid for specific services such as eye exams, and “deductible,” the amount one must pay out-of-pocket before coverage kicks in, are essential for patients to grasp.

Analyzing the Costs of Vision Insurance

Typical premiums for vision insurance plans can vary significantly based on coverage levels, impacting overall budgeting for eye care. Understanding out-of-pocket expenses and deductibles is crucial, as it informs patients about potential costs related to eye surgeries or contact lenses.

Typical Premiums for Vision Insurance Plans

Typical premiums for vision insurance plans can range from $10 to $50 per month, depending on the level of coverage chosen. Physicians often highlight the importance of understanding policy details, as some plans may have lower monthly premiums but higher out-of-pocket expenses.

Out-of-Pocket Expenses and Deductibles Explained

Out-of-pocket expenses associated with vision insurance can significantly impact a person’s financial planning. These costs may include co-pays for eye doctor visits, deductibles for procedures, and charges for contact lenses or glasses not covered by the policy.

Potential Expenses Without Vision Insurance

Without vision insurance, individuals may face significant out-of-pocket expenses for essential eye care services. For example, a comprehensive eye exam can cost anywhere from $100 to $250, depending on the provider and location.

Assessing the Benefits of Vision Insurance

Regular eye exams play a crucial role in maintaining overall vision health, and vision insurance often covers these essential check-ups. In addition, many plans provide discounts on eyewear and contact lenses, greatly reducing out-of-pocket expenses.

Regular Eye Exams and Their Importance

Regular eye exams are crucial for maintaining optimal vision and overall eye health. With insurance policies that cover routine exams, individuals can access these vital services at a significantly reduced out-of-pocket cost.

Discounts on Eyewear and Contact Lenses

Discounts on eyewear and contact lenses are often a significant advantage of enrolling in a vision insurance plan. This benefit can substantially alleviate financial burdens associated with purchasing prescription glasses or contact lenses.

Coverage for Surgical Procedures, Such as LASIK

Vision insurance can provide crucial support for surgical procedures like LASIK, which can significantly enhance a patient’s quality of life.

Situations When Vision Insurance Proves Valuable

Individuals With Pre-Existing Eye Conditions

For individuals with pre-existing eye conditions, having a vision service plan can be invaluable. These plans often cover regular check-ups and necessary treatments, significantly reducing costs.

Families With Children Needing Regular Eye Care

Families with children often face the urgency of regular eye examinations to detect conditions like farsightedness or other vision-related diseases early on.

Those at Higher Risk of Vision Problems

Individuals at higher risk of vision problems can greatly benefit from vision insurance, especially considering the financial implications of treatments.

What to Evaluate Before Purchasing Vision Insurance

Analyzing Personal Eye Care Needs

When assessing personal eye care needs, users should consider their current vision status and any history of issues, such as the requirement for corrective lenses.

Reviewing Available Insurance Plans and Providers

Individuals should carefully assess various insurance plans available on the market to determine which option provides the best investment for their specific needs in optometry.

Comparing Costs vs. Benefits for Individual Circumstances

Individuals considering vision insurance must weigh the costs associated with premiums against the potential benefits related to vision correction.

Understanding the value of vision insurance is crucial for maintaining eye health and managing costs effectively. By evaluating personal needs and available options, individuals can make informed choices that enhance their overall well-being and financial security.